Falling Rupee against Dollar

2011 was the year of great stress for Indian Rupee. It has lost greater than 10 % of its value in the year 2011, making it one of the worst performing currencies in Asia. Logic says rupee appreciation shows the Indian economy is strengthening against US economy and depreciation makes the economy weaker. Overseas funds sold more than US$500 million worth of Indian-listed shares over the last 5 years, reducing net income for 2011 to less than US$300 million – a tiny sum compared with record investments of greater than US$29 billion earned last year, on November 21, 2011 alone.

According to Federal Bank report, the premium banks pay to borrow dollars overnight from central banks will fall by half a percentage point to 50 basis points. The move was coordinated with the monetary authorities in Canada, the U.K, Japan and Switzerland and the Central Bank of Europe.

The Government of India also managed floating exchange rate mechanism. This means that the Indian government interferes only when the circumstances demand and/or if the exchange rate gets out of control by increasing or reducing the money supply.

According to intelligence reports by the Associated Chambers of Commerce and Industry of India, sectors of India Exports are as follows-

The sectors of Import gain if the rupee appreciates. They would have to pay less for the imported raw materials which would increase their profit margins. Likewise, depreciation in rupee value makes exports cheaper and imports expensive.

Hospitality and Tourism: The foreigners who visit India for touring or business purpose would find it cost effective to come to India. This would increase the business opportunities for hotel, tours and travel companies.

IT Sector: India generates more than 70% of its revenue for IT sector from USA. India's IT Sector is dependent on foreign clients. When an IT company gets a project from a client, it decides on the Time and costing of the project. A considerable difference in the performance of a company can be brought about due to the fluctuation in the exchange rate .

Foreign Investors: Foreign investor invests in Indian market and even if its value doesn’t change in 1 year, he’ll earn profit if rupee appreciates and make a loss if it depreciates. Export Boost: The depreciating rupee will boost the exports. The depreciation will benefit the India's IT Sector. The major players like TCS and Infosys can gain. Both these stocks have relevant weightage in the market index. The Indian market will be saved from big crashes.

Reduce Trade Deficit: The main factors for the depreciation of rupee are slowdown in capital flows, high trade and current account deficit and high crude oil prices. To stop fluctuations in rupee it is necessary to reduce these deficits.

RBI Control Policy: When rupee depreciates, it results in a price hike in the petroleum products and fertilizers. This increases the inflation. This becomes a challenging period for RBI. If they increase the key rates, it will affect our growth rate and there will be stock market crash. If it is not, inflation will kill the normal public.

As per analysts say the rupee depreciation is considered as a short term scenario. The Indian market will be a good destination for FIIs in years to come. Huge investment is expected in the coming years. Gradually the rupee will gain its value. Investors need not worry about the rupee depreciation.

Last Updated on September 11, 2025

According to Federal Bank report, the premium banks pay to borrow dollars overnight from central banks will fall by half a percentage point to 50 basis points. The move was coordinated with the monetary authorities in Canada, the U.K, Japan and Switzerland and the Central Bank of Europe.

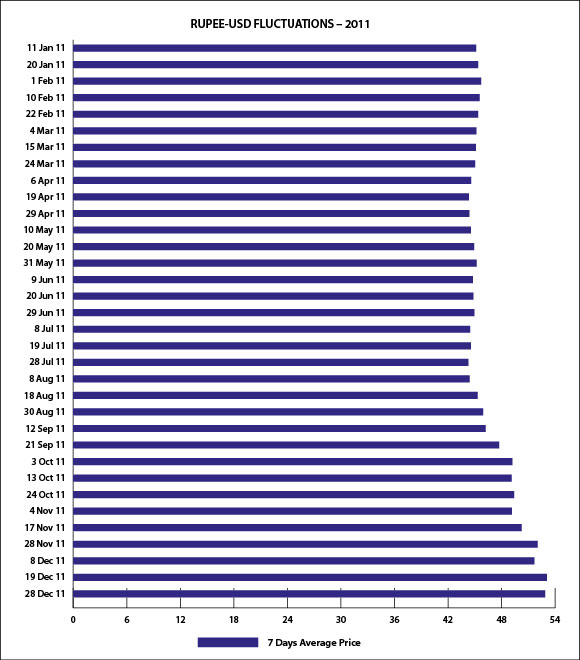

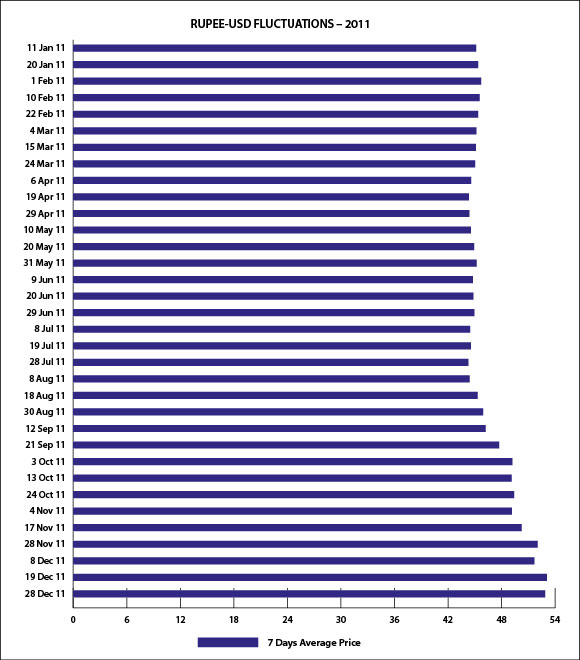

Indian-Rupee and USD Fluctuations – 2011

Below is the graphical representation of movement of Indian-Rupee with respect to US Dollar-

Role of Government of India and Reserve Bank of India(RBI)

The exchange rate is a significant tool used to examine the efficiency of economy. The exchange rate of the Indian rupee is dependent upon the market conditions, where the demand and supply play a major role. In order to foster the effective exchange rates the RBI makes buy and sell transactions to keep the low variability and volatility in exchange rates. RBI also remove the excess liquidity from the economy by increasing the CRR and SLR.The Government of India also managed floating exchange rate mechanism. This means that the Indian government interferes only when the circumstances demand and/or if the exchange rate gets out of control by increasing or reducing the money supply.

Impact of rupee fall on Indian Economy

Rupee appreciation makes imports cheaper and exports more expensive. India's Total Imports and Exports statistics for the period 2010-12 are as follows-| Activity of Trade | Period | Time Period | Amount | Y-o-Y Growth (%) |

|---|---|---|---|---|

| Imports | April-October 2010-11 | April-October 2010-11 | US$210 billion | |

| Imports | April-October 2011-12 | April-October 2011-12 | US$275 billion | 30.95% |

| Exports | April-October 2010-11 | April-October 2010-11 | US$124 billion | |

| Exports | April-October 2011-12 | April-October 2011-12 | US$180 billion | 45.16% |

According to intelligence reports by the Associated Chambers of Commerce and Industry of India, sectors of India Exports are as follows-

| Sector of Import | Share in Total Imports |

|---|---|

| Petroleum | 77 |

| Heavy Engineering Goods | 22 |

| Pharmaceuticals | 19 |

The sectors of Import gain if the rupee appreciates. They would have to pay less for the imported raw materials which would increase their profit margins. Likewise, depreciation in rupee value makes exports cheaper and imports expensive.

Benefits of Rupee Depreciation

Companies: Rupee depreciation is good for industries such as IT, textiles, hotels, technology, micro chips and tourism which generate income mainly from exporting their products or services. It makes goods and services from India, cheaper for overseas buyers, thus leads to increase in demand and higher income for Indians.Hospitality and Tourism: The foreigners who visit India for touring or business purpose would find it cost effective to come to India. This would increase the business opportunities for hotel, tours and travel companies.

IT Sector: India generates more than 70% of its revenue for IT sector from USA. India's IT Sector is dependent on foreign clients. When an IT company gets a project from a client, it decides on the Time and costing of the project. A considerable difference in the performance of a company can be brought about due to the fluctuation in the exchange rate .

Foreign Investors: Foreign investor invests in Indian market and even if its value doesn’t change in 1 year, he’ll earn profit if rupee appreciates and make a loss if it depreciates. Export Boost: The depreciating rupee will boost the exports. The depreciation will benefit the India's IT Sector. The major players like TCS and Infosys can gain. Both these stocks have relevant weightage in the market index. The Indian market will be saved from big crashes.

How to escape from Indian Rupee fluctuations

Hedging: Using forwards and futures contracts help in mitigating the risks arise due to exchange rate fluctuations. This process is known as Hedging, but none-the-less the impact is substantial.Reduce Trade Deficit: The main factors for the depreciation of rupee are slowdown in capital flows, high trade and current account deficit and high crude oil prices. To stop fluctuations in rupee it is necessary to reduce these deficits.

RBI Control Policy: When rupee depreciates, it results in a price hike in the petroleum products and fertilizers. This increases the inflation. This becomes a challenging period for RBI. If they increase the key rates, it will affect our growth rate and there will be stock market crash. If it is not, inflation will kill the normal public.

As per analysts say the rupee depreciation is considered as a short term scenario. The Indian market will be a good destination for FIIs in years to come. Huge investment is expected in the coming years. Gradually the rupee will gain its value. Investors need not worry about the rupee depreciation.

Last Updated on September 11, 2025

| >> More about India Market |

Market Information