Petrochemical Industry

The importance of Petrochemicals is immense. Although we might not realize it, our lives are dependent to quite a large extent on petrochemicals. Petrochemicals are very much a part and parcel of our day to day lives - the carpets that we use to decorate our homes, plastic bottles,clothes that we wear, fertilizers that we use to grow crops, tires, paints, pharmaceuticals,cosmetics etc., are made up of some petrochemicals.

It contains hydrocarbons that come from the downstream processing of crude oil and natural gas. It has extensive usage in several industries, such as agriculture, automotive, construction,plastic, packaging, and personal care. In terms of volume, the petrochemical market in India stood at 42.50 Mn Tons and is estimated to reach 49.62 Mn Tons by 2025. It will expand at a compound annual growth rate (CAGR) of ~6.14% between FY 2021 and FY 2025.

When it comes to volume, the petrochemical market in India ranked at 42.50 Mn Tons and is projected to reach 49.62 Mn Tons by 2025. It will flourish at a compound annual growth rate (CAGR) of ~6.14% between FY 2021 and FY 2025.

Growth Rate -15 percent

Major Player - Reliance

Presently, India has three gas-based and three naphtha-based cracker complexes with a combined annual capacity of 2.9 MMT of ethylene. Besides this, there are also four aromatic complexes with a total of 2.9 MMT of Xylenes.

It contains hydrocarbons that come from the downstream processing of crude oil and natural gas. It has extensive usage in several industries, such as agriculture, automotive, construction,plastic, packaging, and personal care. In terms of volume, the petrochemical market in India stood at 42.50 Mn Tons and is estimated to reach 49.62 Mn Tons by 2025. It will expand at a compound annual growth rate (CAGR) of ~6.14% between FY 2021 and FY 2025.

Petrochemical Industry in India

The petrochemical industry in India has been one of the fastest-growing industries in the country. Since the beginning, the Indian petrochemical industry has shown an enviable growth rate. This industry also contributes largely to the economy of the country and the growth and development of the manufacturing industry. It provides the foundation for manufacturing industries like construction, packaging, pharmaceuticals, agriculture, textiles etc. The Indian petrochemical industry is a highly concentrated one and is oligopolistic. Even till a few days back, only four major companies viz. Reliance Industries Ltd (RIL), Indian Petrochemicals Corporation Ltd. (IPCL), Gas Authority of India Ltd. (GAIL) and Haldia Petrochemicals Ltd. (HPL) used to dominate the industry to a large extent. The amalgamation of IPCL with RIL has made the industry more concentrated further, as they jointly account for over 70% of the country's total petrochemical capacity. However, the scene is slightly different for the downstream petrochemical sector, which is highly fragmented in nature, with over 40 companies existing in the market.When it comes to volume, the petrochemical market in India ranked at 42.50 Mn Tons and is projected to reach 49.62 Mn Tons by 2025. It will flourish at a compound annual growth rate (CAGR) of ~6.14% between FY 2021 and FY 2025.

The Characteristics of Indian Petrochemical Industry

The Petrochemical Industry in India is cyclical. This industry, not only in India but also across the world, is dominated by volatile feedstock prices and sulky demand. India has one of the lowest per capita consumptions of petrochemical products in the world. For example, the per capita consumption of polyester in India lies at 1.4 kg only compared to 6.6 kg for China and 3.3 kg for the whole world. Similarly, the per capita consumption of polymers is 4 kg in India,whereas the per capita consumption is around 20 kg for the entire world.Facts about Petrochemical Industry in India

Market size - US$700 millionGrowth Rate -15 percent

Major Player - Reliance

- According to research conducted by Tata Strategic Management Group, the petrochemical and chemicals sector in India is expected to grow at the rate of 12 to 15 percent in the next five to seven years.

- According to industry experts, this is a phenomenal growth rate compared to the current rate of 3 to 4%. The direct impact of this growth rate would result in investments of around $12 billion to $15 billion.

- In 2020, PM Modi said that India mulls over to grow its refining capacity from nearly 250 million tonnes per annum (mtpa) to 400 mtpa by 2025 as it has planned to double its approximately energy consumption over the long term.

- The oil ministry’s datakeeper Petroleum Planning and Analysis Cell (PPAC) states that India’s refining capacity stands at 249.9 million tonnes, but capacity utilisation was maximum at 254.4 million tonnes in 2019-20. During that time, India undertook 214.1 million tonnes of refined products domestically and exported the rest.

- The rapid expansion is already creating vast amounts of surplus. The surplus created is mostly meant for exports. Reliance Industries is the leader in the petrochemical sector, with a total market share of 70%. We expect RIL core retail revenue to grow at a 36 per cent CAGR over the next four years to $44 bn and expect e-commerce revenues to be 35 per cent of total revenues in FY25 at $15, said a report by Goldman Sachs.

Growth of Petrochemical Industry

The petrochemical industry in India came into existence during the 1970s. The 1980s and The 1990s saw some rapid growth for the Indian petrochemical industry. The biggest reason for this growth was the high demand for petrochemicals in India, which grew at an annual rate of 13 to 14% since the late 90s. It also called for rapid expansion of capacity. The industry suffered setbacks during 2008 due to a surge in the price of crude oil. It will be challenging for the Indian petrochemical industry to plug the deficit of 5mn TPA of ethylene and 4mn TPA of the polymer by 2012 (according to the predictions of the government).Presently, India has three gas-based and three naphtha-based cracker complexes with a combined annual capacity of 2.9 MMT of ethylene. Besides this, there are also four aromatic complexes with a total of 2.9 MMT of Xylenes.

Key Segments in the Indian Petrochemical industry

The petrochemical industry is constituted of the following key segments:- Polymers: The demand for polymers witnessed a growth of 13.4% during 2007 compared to 5.6% in 2006. According to the prediction of Chemicals and Petrochemicals Manufacturers; Association (CPMA), the demand growth for polymers would further be augmented to over 15% in the coming year. The increase in COVID-19 cases has resulted in a decrease in domestic demand in India at the levels of both downstream polymer converters and end-user consumer markets. India’s aggregate yearly imports of all polymers had surged by nearly 160% in the ten years to 2020 to 4,880,010 tons. Exports during the same period pproximately doubled to 2,662,100 tons.

- Polyester Intermediates: The combined production of 5 fibre intermediates (CAN, DMT, Caprolactam, MEG and PTA was 3,417 KT during 2007. Among those, PTA and MEG accounted for 69% and 27%, respectively, while the rest were DMT, Caprolactam and CAN.

- Benzene, Toluene, MX and OX: The demands for Toluene and OX saw a contraction rate of 4% and 10% respectively during 2007. However, Benzene and MX saw positive growth . Benzene and xylene amount to the significant share of the market studied, with nearly 50% of the global market.

Key Issues and Challenges

The petrochemical industry in India is faced with numerous hurdles that prevent it from surpassing other Asian countries.- India's production of ethylene is far lesser than China's. According to experts, the condition is going to remain so for at least the next 5-7 years.

- TThe other important setback for the Indian petrochemical industry is the price of feedstock which is comparatively higher in India as compared to China. India also lags as far as technological development is concerned. India could look for the requirement of over 15 world-scale petrochemicals assets by 2035 to fulfill domestic demand.

Top Petrochemical Companies in India

Though only a few players highly dominate the Indian petrochemical industry, there are a several petrochemical companies in India, doing their share of the business. Some of the top companies can be listed as below:- Reliance Industries Ltd.

- Haldia Petrochemicals Ltd.

- Indian Oil Corporation

- Gas Authority of India Limited

- National Organic Chemical Industry Ltd.

- Bongaigaon Refinery and Petrochemicals Ltd.

- Manali Petrochemical Limited

- I G Petrochemicals Limited

- The Andhra Petrochemicals Limited

- Tamilnadu Petroproducts Limited

For more information contact :

[email protected]

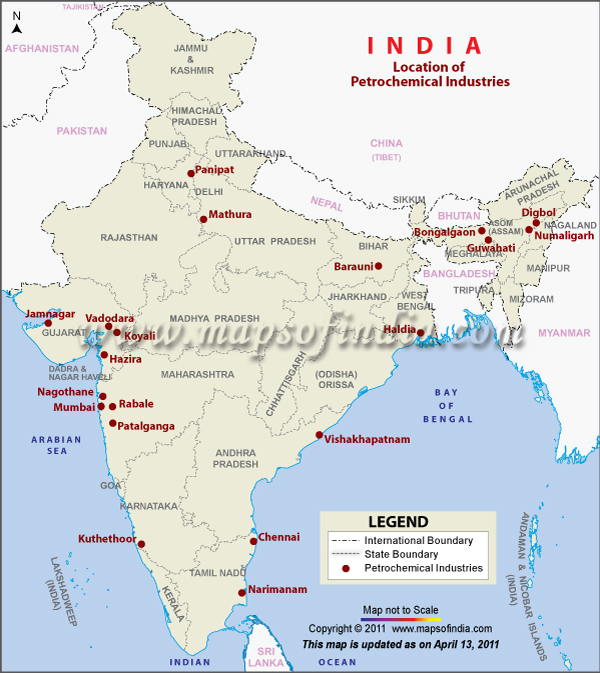

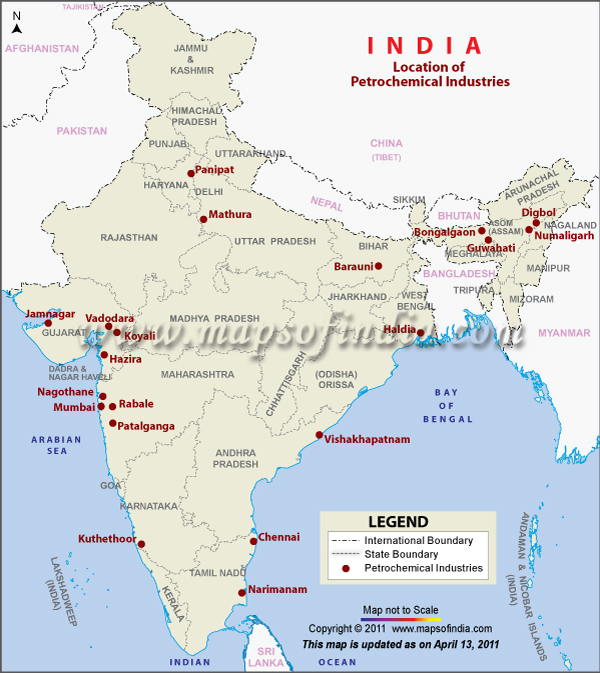

Disclaimer : All efforts have been made to make this image accurate. However Compare Infobase Limited and its directors do not own any responsibility for the correctness or authenticity of the same.

Last Updated on July 14, 2025Disclaimer : All efforts have been made to make this image accurate. However Compare Infobase Limited and its directors do not own any responsibility for the correctness or authenticity of the same.