India vs China Economy

Making an in depth study and analysis of India vs. China economy seems to be a very hard task. Both India and China rank among the front runners of global economy and are among the world's most diverse nations. Both the countries were among the most ancient civilizations and their economies are influenced by a number of social, political, economic and other factors. However, if we try to properly understand the various economic and market trends and features of the two countries, we can make a comparison between Indian and Chinese economy.

Going by the basic facts, the economy of China is more developed than that of India. While India is the 11th largest economy in terms of the exchange rates, China occupies the second position surpassing Japan. Compared to the estimated $1.3123 trillion GDP of India, China has an average GDP of around $4909.28 billion. In case of per capital GDP, India lags far behind China with just $1124 compared to $7,518 of the latter. To make a basic comparison of India and China Economy, we need to have an idea of the economic facts of the countries.

If we make the analysis of the India vs. China economy, we can see that there are a number of factors that has made China a better economy than India. First things first, India was under the colonial rule of the British for around 190 years. This drained the country's resources to a great extent and led to huge economic loss. On the other hand, there was no such instance of colonization in China. As such, from the very beginning, the country enjoyed a planned economic model which made it stronger.

Agriculture is another factor of economic comparison of India and China. It forms a major economic sector in both the countries. However, the agricultural sector of China is more developed than that of India. Unlike India, where farmers still use the traditional and old methods of cultivation, the agricultural techniques used in China are very much developed. This leads to better quality and high yield of crops which can be exported.

One of the sectors where Indi enjoys an upper hand over China is the IT/BPO industry. India's earnings from the BPO sector alone in 2010 is $49.7 billion while China earned $35.76 billion. Seven Indian cites are ranked as the world's top ten BPO's while only one city from China features on the list

In spite of being a Socialist country, China started towards the liberalization of its market economy much before India. This strengthened the economy to a great extent. On the other hand, India was a little slow in embracing globalization and open market economies. While India's liberalization policies started in the 1990s, China welcomed foreign direct investment and private investment in the mid 1980s. This made a significant change in its economy and the GDP increased considerably.

Compared to India, China has a much well developed infrastructure. Some of the important factors that have created a stark difference between the economies of the two countries are manpower and labor development, water management, health care facilities and services, communication, civic amenities and so on. All these aspects are well developed in China which has put a positive impact in its economy to make it one of the best in the world. Although India has become much developed than before, it is still plagued by problems such as poverty, unemployment, lack of civic amenities and so on. In fact unlike India, China is still investing in huge amounts towards manpower development and strengthening of infrastructure.

Tax incentives are one area where China is lagging behind India. The Chinese capital market lags behind the Indian capital market in terms of predictability and transparency. The Indian capital or stock market is both transparent and predictable. India has Asia's oldest stock exchange which is the BSE or the Bombay Stock Exchange. Whereas China is home to two stock exchanges, namely the Shenzhen and Shanghai stock exchange. As far as capitalization is concerned the Shanghai Stock Exchange is larger than the BSE since the SSE has US$1.7 trillion with 849 listed companies and the BSE has US$1 trillion with 4,833 listed companies. But more than the size what makes both these stock exchanges different is that the BSE is run on the principles of international guidelines and is more stable due to the quality of the listed companies. In addition to this the Chinese government is the major stake holder of most of its State-owned organizations hence the listed firms have to run according to the rules and regulations laid down by the government. Hence India is ahead of China in matters of financial transparency.

It is said that Indians have great managerial skills. India also leaves China behind as far as management abilities are concerned. As compared to China India has better managed companies. One of the major reasons for this is that management reform training in China began 30 years ago and sadly the subject has still not picked up as a matter of interest by the citizens of the country. Another important factor behind China not doing well in the business forefront is that most of the countries came to China and manufactured their goods. It was not Chinas exports that drove the economy instead it was the export products of outsiders. Even in the case of mergers and acquisitions China still has not managed to do too well. On the other hand Indian companies are rapidly expanding mergers and acquisitions. Some of the recent examples include; Tata Steel's $13.6 Billion Acquisition of Corus, Tata Tea's purchase of a controlling stake in Britain's Tetley for US$407 million, Indian Pharmaceutical giant Ranbaxy's acquisition of Romania's Terapia etc.

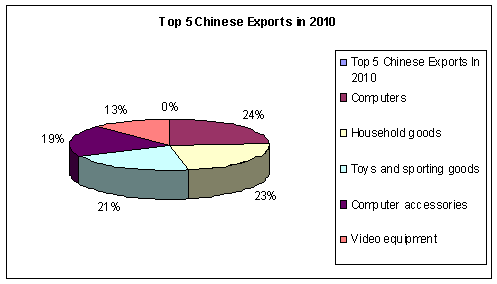

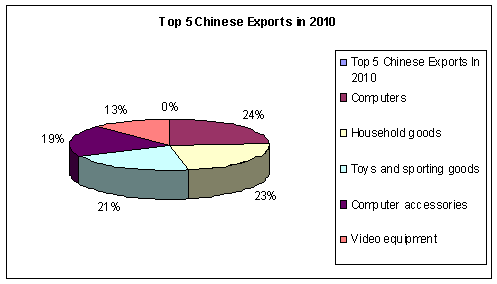

As far as exports of both the countries are concerned both the countries managed to do pretty well in 2010.China's total imports and exports stood at US $2677.28 billion at the end of November 2010. India's exports grew by 26.8% and imports increased by 11.2%. Below is presented details about China's import and exports for the year 2010.

Last Updated on September 11, 2025

Going by the basic facts, the economy of China is more developed than that of India. While India is the 11th largest economy in terms of the exchange rates, China occupies the second position surpassing Japan. Compared to the estimated $1.3123 trillion GDP of India, China has an average GDP of around $4909.28 billion. In case of per capital GDP, India lags far behind China with just $1124 compared to $7,518 of the latter. To make a basic comparison of India and China Economy, we need to have an idea of the economic facts of the countries.

| Facts | India | China |

| GDP | around $1.3123 trillion | around 4909.28 billion |

| GDP growth | 8.90% | 9.60% |

| Per capital GDP | $1124 | $7,518 |

| Inflation | 7.48 % | 5.1% |

| Labor Force | 467 million | 813.5 million |

| Unemployment | 9.4 % | 4.20 % |

| Fiscal Deficit | 5.5% | 21.5% |

| Foreign Direct Investment | $12.40 | $9.7 billion |

| Gold Reserves | 15% | 11% |

| Foreign Exchange Reserves | $2.41 billion | $2.65 trillion |

| World Prosperity Index | 88Th Position | 58th Position |

| Mobile Users | 842 million | 687.71 million |

| Internet Users | 123.16 million | 81 million. |

Agriculture

Agriculture is another factor of economic comparison of India and China. It forms a major economic sector in both the countries. However, the agricultural sector of China is more developed than that of India. Unlike India, where farmers still use the traditional and old methods of cultivation, the agricultural techniques used in China are very much developed. This leads to better quality and high yield of crops which can be exported.

IT/BPO

One of the sectors where Indi enjoys an upper hand over China is the IT/BPO industry. India's earnings from the BPO sector alone in 2010 is $49.7 billion while China earned $35.76 billion. Seven Indian cites are ranked as the world's top ten BPO's while only one city from China features on the list

Liberalization of the market

In spite of being a Socialist country, China started towards the liberalization of its market economy much before India. This strengthened the economy to a great extent. On the other hand, India was a little slow in embracing globalization and open market economies. While India's liberalization policies started in the 1990s, China welcomed foreign direct investment and private investment in the mid 1980s. This made a significant change in its economy and the GDP increased considerably.

Difference in infrastructure and other aspects of economic growth

Compared to India, China has a much well developed infrastructure. Some of the important factors that have created a stark difference between the economies of the two countries are manpower and labor development, water management, health care facilities and services, communication, civic amenities and so on. All these aspects are well developed in China which has put a positive impact in its economy to make it one of the best in the world. Although India has become much developed than before, it is still plagued by problems such as poverty, unemployment, lack of civic amenities and so on. In fact unlike India, China is still investing in huge amounts towards manpower development and strengthening of infrastructure.

Company Development

Tax incentives are one area where China is lagging behind India. The Chinese capital market lags behind the Indian capital market in terms of predictability and transparency. The Indian capital or stock market is both transparent and predictable. India has Asia's oldest stock exchange which is the BSE or the Bombay Stock Exchange. Whereas China is home to two stock exchanges, namely the Shenzhen and Shanghai stock exchange. As far as capitalization is concerned the Shanghai Stock Exchange is larger than the BSE since the SSE has US$1.7 trillion with 849 listed companies and the BSE has US$1 trillion with 4,833 listed companies. But more than the size what makes both these stock exchanges different is that the BSE is run on the principles of international guidelines and is more stable due to the quality of the listed companies. In addition to this the Chinese government is the major stake holder of most of its State-owned organizations hence the listed firms have to run according to the rules and regulations laid down by the government. Hence India is ahead of China in matters of financial transparency.

Company Management Capabilities

It is said that Indians have great managerial skills. India also leaves China behind as far as management abilities are concerned. As compared to China India has better managed companies. One of the major reasons for this is that management reform training in China began 30 years ago and sadly the subject has still not picked up as a matter of interest by the citizens of the country. Another important factor behind China not doing well in the business forefront is that most of the countries came to China and manufactured their goods. It was not Chinas exports that drove the economy instead it was the export products of outsiders. Even in the case of mergers and acquisitions China still has not managed to do too well. On the other hand Indian companies are rapidly expanding mergers and acquisitions. Some of the recent examples include; Tata Steel's $13.6 Billion Acquisition of Corus, Tata Tea's purchase of a controlling stake in Britain's Tetley for US$407 million, Indian Pharmaceutical giant Ranbaxy's acquisition of Romania's Terapia etc.

China's Import & Export (2010/11)

As far as exports of both the countries are concerned both the countries managed to do pretty well in 2010.China's total imports and exports stood at US $2677.28 billion at the end of November 2010. India's exports grew by 26.8% and imports increased by 11.2%. Below is presented details about China's import and exports for the year 2010.

China's import and exports for the year 2010.

| Absolute Value for November | Year-on-year growth % for November | Absolute Value for first 11 months | Year-on-year growth % for first 11 months | |

| Export Value | 1533.3 | 34.9 | 14238.4 | 33.0 |

| Import Value | 1304.4 | 37.7 | 12534.3 | 40.3 |

| Total Import and Export Value | 2837.6 | 36.2 | 26772.8 | 36.3 |

| Import and Export Balance | 228.9 | 20.7 | 1704.1 | -3.9 |

Last Updated on September 11, 2025

More on India Economy