Budget 2013 and its effects on Tax Planning

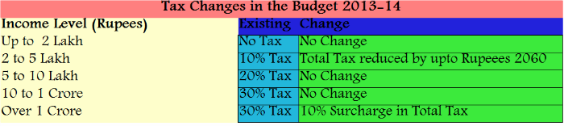

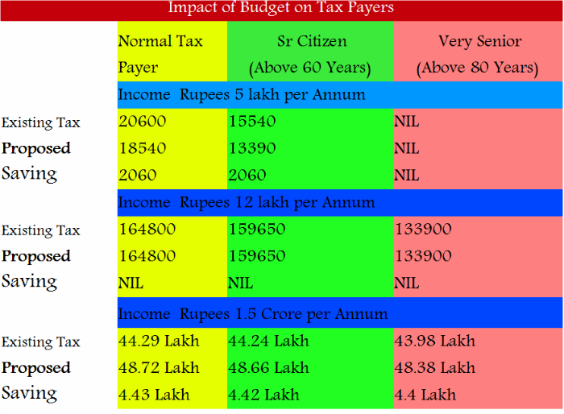

Lets look at how the Union Budget 2013 Tax Proposals is going to effect our Tax planning- No change in Tax rates on income up to Rupees 2 lakh

- Income in the bracket of Rupees 2-5 lakh braket Total tax is reduced by Rupees 2060 which is very marginal

- There is no change in the tax rates for other income categories except those who have income level above Rupees one Crore. A new surcharge of 10% is imposed on the total tax payable by them.

- The Rupees one lakh tax saving which was set in 2005 with the introduction of section 80c in 2005, still holds.

- A new section is introduced under income tax act Section 80ccd(2) which says that up to 10 % of the basic salary of the employee is fully deductible if intvested in in National Pension Schemes (NPS) by the employer on behalf of the employee.

Last Updated on 03/07/2013